Planned Giving

Gifts of Stock and Appreciated Assets

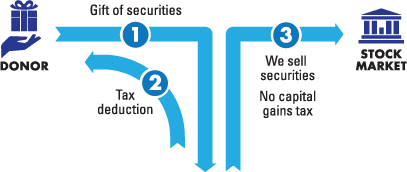

How It Works

- You transfer appreciated stocks, bonds, or mutual fund shares you have owned for more than one year to Montefiore Medical Center.

- Montefiore Medical Center sells your securities and uses the proceeds for its programs.

- Download our Stock Transfer Form here.

Benefits

- You receive an immediate income tax deduction for the fair market value of the securities on the date of transfer, no matter what you originally paid for them.

- You pay no capital gains tax on the transfer when the stock is sold.

- Giving appreciated stock could be more beneficial than giving cash.

Next

- Frequently asked questions on gifts of stock.

- Contact us so we can assist you through every step.